Full-year demand for air cargo took a significant step back from 2021 levels in 2022 – but was close to 2019 performance.

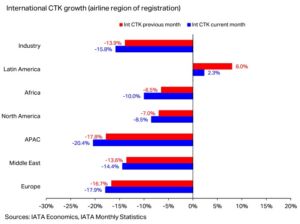

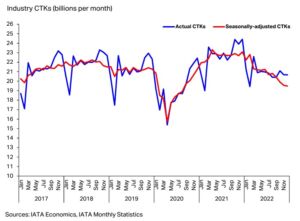

That’s according to the International Air Transport Association (IATA), whose data showed that global full-year demand in 2022, measured in cargo tonne-kilometres (CTKs), was down 8.0 per cent compared to 2021, dropping 8.2 per cent for international operations. Compared to 2019, it was down 1.6 per cent (both global and international).

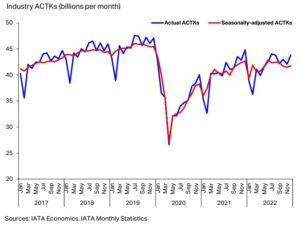

Capacity in 2022, measured in available cargo tonne-kilometres (ACTKs), was 3.0 per cent above 2021 ( up 4.5 per cent for international operations). Compared to pre-Covid 2019 levels, capacity fell 8.2 per cent (down 9.0 per cent for international operations).

IATA’s data also showed that December saw a softening in performance: global demand was 15.3 per cent below 2021 levels (down 15.8 per cent for international operations). Monthly cargo demand tracked below 2021 levels from March 2022. Global capacity was 2.2 per cent below 2021 levels (0.5 per cent for international operations). This was the tenth consecutive monthly contraction compared to 2021 performance, IATA said.

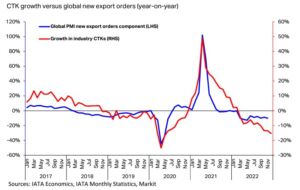

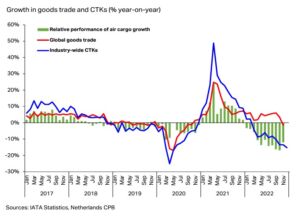

2022 ended with mixed signals, IATA added. Global new export orders, a leading indicator of cargo demand, have stayed at the same level since October. For major economies, new export orders are shrinking except in Germany, the US, and Japan, where they grew.

Global goods trade decreased by 1.5 per cent in November, down from a 3.4 per cent increase in October.

The Consumer Price Index for G7 countries indicated inflation tracking at 6.8 per cent for December. The 0.6 percentage point drop compared to November (7.4 per cent) was the largest over the course of year. Inflation in producer (input) prices reduced to 12.7 per cent in October, its lowest level so far in 2022.

“In the face of significant political and economic uncertainties, air cargo performance declined compared to the extraordinary levels of 2021,” commented IATA’s director general Willie Walsh. “That brought air cargo demand to 1.6 per cent below 2019 (pre-pandemic) levels. The continuing measures by key governments to fight inflation by cooling economies are expected to result in a further decline in cargo volumes in 2023 to -5.6 per cent compared to 2019.

“It will, however, take time for these measures to bite into cargo rates. So, the good news for air cargo is that average yields and total revenue for 2023 should remain well above what they were pre-pandemic. That should provide some respite in what is likely to be a challenging trading environment in the year ahead.”