Can online booking platforms be a game-changer for air cargo?

With online booking platforms becoming more popular, is a tipping point on the way? Kevin Rozario reports.

Online booking platforms are gaining more traction in the air cargo business, helped by e-commerce growth and demand for faster shipping. However, after the pandemic boom, yields have begun to fall from their COVID peaks: from over $4/kg at the end of 2021 to $2.95 in early 2023, according to McKinsey. The efficiencies of digital bookings are therefore looking more enticing.

This year, big players in the sector are looking to take more share and are using the full gamut of improved tech, better integration with other logistics systems, smarter data analytics, and customised services to achieve their goals.

cargo.one claims to be the market leader for airlines in the digital space. In the past 18 months, it has seen 400% growth in new airline and route combinations becoming available for instant digital booking and it is adding large amounts of new capacity.

Moritz Claussen, cargo.one’s founder and co-chief executive, told Air Cargo Management: “Digital booking is fast becoming the norm, not the exception, for many shipment types. The proportion of digital sales will overtake offline channels in just a couple of years. We continue to harness our vast platform data to equip forwarders with valuable insights enabling them to discover and book the best capacities and rates for every shipment.”

The chief executive offers up a very simple equation: forwarders that are fastest to quote for a request, are much likelier to win a deal on average. “To quote swiftly, forwarders require end-to-end visibility of their rates, most importantly their air freight costs,” he said.

Using cargo.one pro, forwarders have access to live rates of more than 55 global airlines, but other rates too, including pre- and post-carriage. A new quoting tool also means they can digitally create and share a quote with their customers “in seconds without having to copy and paste rates or other information” according to Claussen.

cargo.one expects this all-in-one approach to keep it at the forefront of the market. The company also has extensive API suites so that forwarders can integrate search and book capabilities across its airline partners into their trade management systems, consume real-time data in business intelligence applications, or manage global rate databases.

Claussen said: “cargo.one delivers fully digital instant quoting, pricing, and booking – in whatever endpoint or form is required – and is now the only platform a freight forwarder needs, from single-branch SMEs to the world’s top 10 forwarders.”

“Hungry for digitalisation”

That is a strong pitch, but others are also vying for this business – and growing fast. WebCargo by Freightos had under 10,000 bookings in Q3 2020 but by Q3 2023 it had topped 269,000. Antonia Ambrozy, director of eBookings growth, said: “This growth is proof that the freight industry remains hungry for digitalisation, be it for e-bookings or flexible environments that allow staff to work efficiently across time zones (using) 24/7 online tools and digital rate management.

“Our mission is to digitalise freight. In order to make this a reality, we need to work in partnership with other systems to provide a best in-class experience. International freight is one of the last remaining offline industries. Analogue often translates into extra costs, delays, unpredictability, inflexibility, and extra carbon emissions.”

While the ‘dark ages’ of analogue systems remain, more companies are moving to online. In Sweden, PJN Logistics & Consulting is of them and a customer of cargo.one. “Before digital platforms, airlines wanted us to book via their own portals,” said founder Peter Johansson, “It’s okay if you only have a couple of shipments per day, but if you have many, and need to check five different airline websites for rates and communicate that to your client, it just takes too long.”

For this reason alone, online booking platforms are becoming popular, and improving. Joe Quijano Saumet, vice president of product at Freightos, said: “Standardisation technologies will enhance efficiency by streamlining communication across logistics components.” He believes that AI will play a vital role in optimising route planning, predicting demand and improving supply chain visibility.

A study from the McKinsey Global Institute has identified that travel, transport, and logistics have the most potential for incremental value gains from AI, amounting to $1.8 trillion. “Airlines must invest in digitalisation, incorporating technologies like IoT and AI for real-time tracking, cloud-based data storage, and predictive maintenance. These advancements can create a more efficient, interconnected, and customer-centric air cargo ecosystem,” said Quijano Saumet.

CargoAi also accepts that technology has a crucial role in the evolution of online booking platforms. Its chief executive, Matt Petot, said: “Overall, 2024 looks promising as technology providers – such as CargoAi with its digital portfolio from booking, track and trace and cross-border payment solutions – continue to elevate their capabilities.”

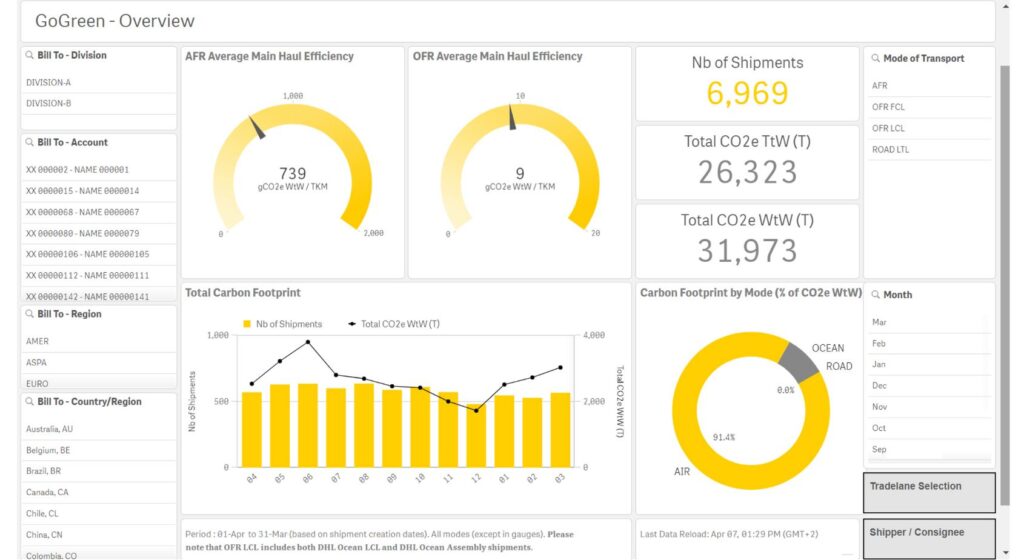

As one of the biggest air cargo players in the world, DHL confirmed its commitment to online. Max Sauberschwarz, global head of air freight at DHL Global Forwarding told Air Cargo Management: “Digitalisation is fundamental to our business strategy known as ‘Simplify’. The name highlights the benefits we recognise in tools like online booking platforms.”

The company introduced its customer platform, myDHLi, in 2020 as a one-stop portal offering an online booking tool for air cargo and other transport modes. It also includes features such as myDHLi Track, analytics, reports, and documents. “These functionalities not only enhance the efficiency and convenience of booking shipments but provide a new level of transparency and productivity for customers,” said Sauberschwarz. “Additionally, our collaboration with various air carriers through APIs ensures seamless data exchange among all parties.”

This article continues after the below picture…

AI and ML for the long haul

As AI and machine learning become more embedded, predictability for any scenario will be improved whether it is streamlining specific products/commodities or industries or making last-minute booking easier by ironing out volatility. According to McKinsey, due to the increase in online sales, cargo airlines have more data available than ever about their customers’ behaviour to achieve this.

For example, cargo.one’s scale (in 116 countries) means it can provide forwarders with valuable learnings from the compliant data it holds such as live market guidance using AI on real shipments information every day. This, says the company, allows customers to achieve better buy rates and quote shippers faster. This set-up is the catalyst that leading forwarders are now using to supercharge air freight operations.

McKinsey noted: “Through digitalisation, the air cargo industry has an opportunity to build a 360-degree view of demand across the entire customer journey which includes data that is above the sales funnel, for example, which flights customers search for, lead times, how the cargo request was made, how long it took to fulfil, and if there was a cancellation or modification.”

However, having a digital platform is not enough. Securing efficient and comprehensive end-to-end logistics and transport services is the goal. Consolidation of platforms and/or providers has been one way to achieve this but there are differing views on the impact.

CargoAi believes consolidation of platforms can offer advantages including economies of scale, cost efficiency, and increased competitiveness leading to more standardised practices and better interoperability. Petot said: “A consolidated market may result in more resilient platforms with enhanced capabilities. However, careful consideration is needed to strike a balance, ensuring that consolidation does not lead to a lack of diversity or monopolistic practices.

Freightos has added logistics providers, such as 7LFreight, to its portfolio to widen its offer. Quijano Saumet said: “In this case, we’re lucky that we don’t have to reinvent the wheel but can build on other systems’ experience. Our growth encourages us to continue pursuing this path.”

This article continues after the below picture…

Consolidation and a wider offer

The company believes there are two main considerations related to consolidation. Firstly, whether any product alignment fits with industry needs; in other words, creating products that are more industry-specific and in tune with the unique requirements of the air cargo sector. And secondly, ensuring integration with current systems to ensure compatibility and improved operations.

This is all well and good, but cargo.one notes that consolidation should not mean that digital capabilities are only funnelled to businesses with deep pockets. Chief executive Claussen said: “Our platform – with a low barrier to entry – has levelled up the gains from digital transformation for forwarders and airlines. Freight forwarders need to work with a platform that delivers the most extensive and diverse market offers. Our brand new ‘live estimates’ functionality is helping forwarders of all sizes to transform their accuracy and competitiveness in their daily rate setting and quoting.”

He added: “cargo.one is also a strong example of how platforms should be independent from their beginning and fully transparent about their investors, have no airlines on board seats, and be free of any control or influence from airlines or large forwarders.”

At the macro level, DHL is well aware of the complexity of global supply chains and where online booking platforms fit in. Sauberschwarz said: “The current situation in the Red Sea emphasises the importance of a combination of digital solutions, a physical network, and highly skilled experts. Consolidation further highlights the need for customers to have a reliable partner who can deliver solutions even in challenging situations.”

DHL argues that its extensive global network, along with the right suite of digital solutions, means that it can provide these solutions. This includes modal shifts, re-routing, or dedicated air charters when other options are limited. “Combining our digital expertise with our ability to adapt in crises, like the COVID-19 pandemic, sets us apart,” added Sauberschwarz.

Online booking platforms still have some way to go in terms of scaling to help the air cargo industry on its digitalisation journey. But as players in this space become more global – with digitalisation across more systems and processes – the market can only go one way. These platforms have the resources for meaningful targeted innovation.

A recent example is digital agent-to-agent booking with cargo.one pro, which is proving to be an attractive proposition for forwarders. More standardisation and efficiencies from competitors should bring further tangible benefits like this to the air cargo industry in the immediate, and foreseeable, future.

READ MORE IN DEPTH FEATURES FROM AVIATION BUSINESS NEWS HERE