Last year, the sector was in the headlines for all the wrong reasons. Is 2024 the year to move on? Kevin Rozario reports.

Recapping 2023, engine MRO companies suffered several setbacks – mostly external but some self-inflicted – while rebuilding their operations post-pandemic.

In MRO Management, we reported extensively on the supply chain disruptions of parts and materials; workforce shortages – particularly for skilled technicians – that lengthened turnaround times (TATs) and costs; and the geopolitical uncertainties brought on by conflicts in Ukraine and, latterly, Israel-Palestine.

Adding to these woes is instability for cargo in the Gulf of Aden/Red Sea where attacks on ships by Yemeni Houthis in support of Palestinians have led the US and the UK to take military action in Yemen. About 20% of global shipping goes through the stretch of water in order to cross the Suez Canal and all eyes are on this increasingly perilous zone which could affect global supply chains and oil prices.

These external factors were compounded last year by damaging revelations for the engine MRO business when claims emerged that parts from London‑based AOG Technics were supplied without valid certification and had been found in CFM56 and CF6 engines, among others.

CFM International – a 50:50 joint venture between GE and Safran Aircraft Engines – made the allegations in a London court in September. By December 6, the UK’s Serious Fraud Office (SFO) had launched a criminal investigation into AOG Technics, arresting one individual.

The SFO stated that the parts were mostly sold to overseas companies as well as some UK airlines, maintenance providers and parts suppliers. At the time, Nick Ephgrave, director of the SFO, said his organisation “was determined to establish the facts as swiftly as possible” and noted that they could have “potentially far-reaching consequences”.

This is the kind of publicity the engine MRO business could have done without as it entered 2024, but it may also help tighten up regulations and/or audits for smaller suppliers.

Despite the knocks, confidence should be better than last year as forecasters predict a recovery to pre-Covid levels. There have been signs of a turnaround with bookings up and workshops full. Delays in new engine production from OEMs have also boosted demand for MRO services on existing units.

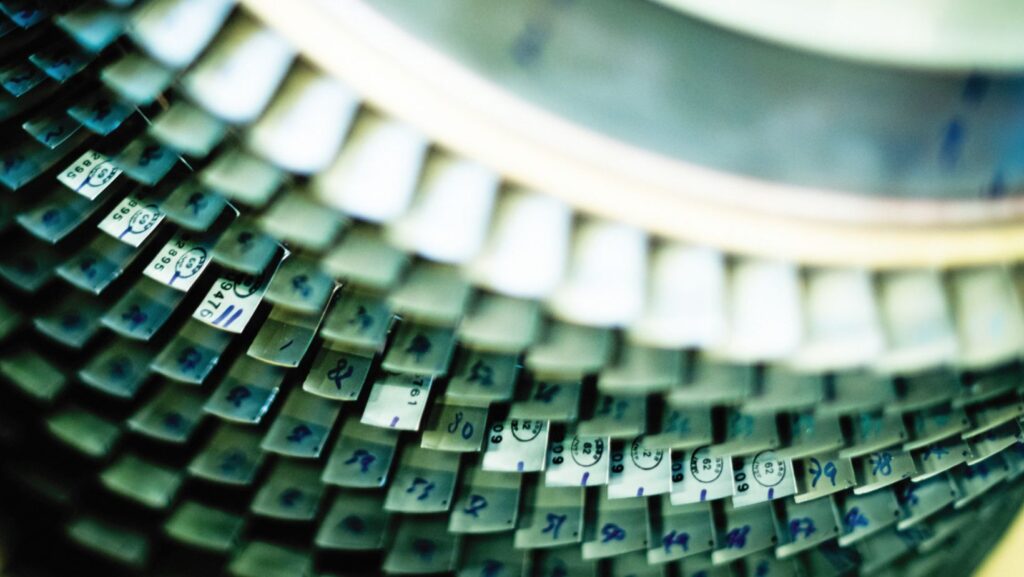

This article continues after the below picture…

Supply chains remain a concern

Supply chains normalised somewhat last year but are far from restored. At Pratt & Whitney, Kevin Kirkpatrick vice president of aftermarket global operations, comments: “While we saw supply chain improvements in 2023 which resulted in year-on-year growth, industry-wide pressures continue to affect material availability. We are balancing growing production rates with higher fleet utilisation while the supply base recovers.”

Red Sea disruptions are not expected to affect the high-value engine MRO supply side directly. Evren Akca, global account manager at Aero Norway, says: “Engines and engine parts are typically not transported via sea. However, the situation could affect oil prices and air transport demand.”

Locatory.com, the parts and supplies marketplace which is part of Avia Solutions Group, sees titanium supply as a continuing issue. Chief executive Toma Matutyte says: “Ukraine’s rich titanium resources, particularly the deposits in the Zaporizhia region, have played a crucial role in global supply. However, the annexation of Crimea by Russia and the war in Ukraine have disrupted this supply chain.”

Titanium is very temperature stable and corrosion resistant, with an excellent strength-to-weight ratio. It is increasingly used in the production of airframe and engine components, with global demand from big makers like Boeing and Airbus on the rise.

At MTU Aero Engines, the general supply-side situation got to the point where the company stopped providing estimates of when things might normalise and concentrated instead on the factors it could influence. Martin Friis-Petersen, senior vice president, MRO Programs, explains: “Our main focus is on managing and optimising turnaround times and costs for customers. We are working across our entire network and in all regions to limit the impact.”

At the same time, the company has stuck to investment plans for maintenance capacity, including recruiting and retaining personnel to ensure it is well-positioned to handle an increasing need for maintenance. For example, to mitigate slow-moving shop visits, MTU Maintenance Zhuhai is being expanded by adding a secondary facility, while MTU Maintenance Serbia was built specifically for parts repair.

Likewise, other bigger players are looking to increase output. Pratt & Whitney has embedded staff with key suppliers to help accelerate the delivery of parts and to assist with staff training to add more qualified personnel.

Identifying growth spots

GE90-115B and CF6-80C2 engines remained strong for MTU during the pandemic, while engines catering mainly to the passenger market suffered, particularly older, less efficient aircraft. According to the company it has 18% more CF6-80C2 engines in service than in January 2020 and 8% more than in January 2023.

“Total CF6-80C2 cycles are a little softer with only a 4% increase in 2023’s flying compared to 2020, but remember 2020 was a strong year for cargo operations,” says Friis-Petersen. It is possible that CF6-80C2 demand may have peaked, but there is likely to be considerable MRO demand for this engine for many more years, according to the senior vice president.

MRO demand for narrowbody engines recovered well in 2023, with strong ongoing CFM56 shop visits, especially the CFM56-7B. Pratt & Whitney’s engine issues have also been positive for some. “We continue to see early technical removal and correspondingly high shop-visit demand on the newer engine models such as the PW1100GJM and PW1500G as well as the LEAP,” Friis‑Petersen comments.

That has a double benefit. “As a consequence of the fleet challenges with the latest-generation engines, more of the flying burden falls back on legacy engines such as CFM56 and V2500. Consequently, we are seeing more MRO demand for these engines than was originally forecast,” adds Friis-Petersen.

Wales-based AerFin has also taken advantage. It has taken delivery of 11 CFM56 and nine V2500 engines, bringing the total number of units it has acquired since 2013 to 250 to ensure the availability of used serviceable material (USM). Auvinash Narayen, senior vice president for trading, says that the engine acquisition strategy was instrumental to building a substantial inventory portfolio for regional and narrow-body platforms.

For Pratt & Whitney, the focus is on expanding capacity, and adding advanced technologies at its engine MRO facilities. Kirkpatrick says: “We are increasing our global GTF MRO footprint by making additional investments in our own shops, hiring hundreds of employees and adding industry-leading providers.”

The network now has 15 active sites globally, with five facilities activated in 2023 and plans for an additional four by 2025, taking the total to 19. This will allow for more than 2,000 annual shop visits in 2025, a roughly fivefold increase from 2019.

Kirkpatrick adds: “Since we identified a rare condition in powdered metal used to manufacture certain parts – requiring accelerated inspections of GTF engines – our focus is on executing all elements of the fleet management plan, in particular, industrial output and material flow, MRO output and customer support.”

This article continues after the below picture…

More AI, robotics and digital twins

Efficiency has been stepped up in the engine MRO business in general, helped by AI, robotics, digital twins and other technologies. Aero Norway’s Akca believes digital tech will play a major role in enhancing productivity: “The trend is towards integrating these technologies for better predictive maintenance, real-time monitoring and workflow management. For example, digital twins offer significant benefits by providing virtual replicas of engines, helping with evaluation and reducing unplanned downtimes.”

Similarly, MTU is tracking engine on-wing performance and building a maintenance programme using the collected data. This helps in predicting when maintenance has to be carried out and how extensive the work will be. MTU Maintenance uses Cortex, an in-house developed and AI-assisted software, to forecast maintenance scenarios.

“Using AI optimisation algorithms and taking into account variable parameters such as utilisation, operational conditions, parts availability, cost structures and engine health (engine trend monitoring), the software produces cost-optimised scenarios and recommendations to operators,” says Friis-Petersen. The tool can forecast material needs down to life-limited part (LLP) level and calculates spare engine requirements to cover respective MRO intervals.

Pratt & Whitney, too, is investing in several initiatives including product-specific digital twins in what Kirkpatrick refers to as the “digital thread” to connect data from enterprise resource planning (ERP), product lifecycle management (PLM), and manufacturing execution system (MES) platforms.

Examples include the launch of Percept, an AI-based aircraft engine analysis tool. Percept is a computer vision and AI platform built by Awiros, a startup based outside Delhi, India. Its cloud-based interface allows users to capture images and videos of engines on their mobile devices and receive real-time responses on parts availability.

Meanwhile, at the company’s Singapore engine centre, engineers have developed a collaborative robot (cobot). The integration of cobot with camera systems and advanced sensors capture and document hundreds of pictures at different locations on the engine. This replaces the time-consuming photo-documentation task previously performed by technicians.

Elsewhere, Pratt & Whitney is leveraging smart glasses and wearable tech with integrated cameras, a small screen, and audio that enables hands-free communication for uses such as training, troubleshooting and equipment qualification. And in 2023, the company successfully deployed the first-in-MRO application of 3D printing for aero engine component details.

Guarded growth expectations

Such tech advances and investment commitments should help reduce time in shops. So, while the engine MRO business has had a turbulent year, the outlook for 2024 has many positives – despite supply constraints not going away.

Contract wins will also play their part. On January 12, Rolls-Royce announced plans to implement a TotalCare maintenance agreement with Taiwanese airline EVA Air for 36 Trent XWB‑97 engines to power 18 new Airbus A350‑1000s. This will be the first time EVA Air will include the Trent unit in its fleet. The XWB-97 has more than two million engine flying hours under its belt over five years of service and that will rise to more than five million by 2025.

Aero Norway’s Akca believes engine MRO will grow this year, but it won’t be straightforward. “It’s influenced by varying demands for different engine types and further complicated by the supply chain challenges that could potentially be disruptive,” he says. “Aero Norway’s strategic approach (is to) focus on adaptability and effective utilisation of USM.”

For MTU, there are strong growth expectations especially for cargo. Friis‑Petersen says: “For mature widebody engines, although the cargo market softened in 2023, MRO demand has increased in the past 12 months, and we expect that will continue over the next few years.”

This feature was first published in MRO Management – January/February 2024. To read the magazine in full, click here.