Airlines expect to increase their revenues by up to 18% by adopting modern retailing and ecommerce technologies, a major new study has revealed.

Aviation sector IT giant Amadeus has collated the views of senior IT executives at 100 airlines including 50 low cost carriers and 50 full service, for a new Travel Technology Investment Trends 2024 report.

The firm is due to release a number of reports over the coming months focussed on different areas of the aviation sector and this week published its airline and travel agent focussed findings.

It found that, overall, the airline industry expects to increase its investment in IT systems by 13% this year with the key aim of using technology to improve the traveller experience.

Some of this investment will be directed towards the in-airport experience, with two thirds of airlines due to roll out biometric solutions this year, but the industry is also prioritising the move towards modern retailing.

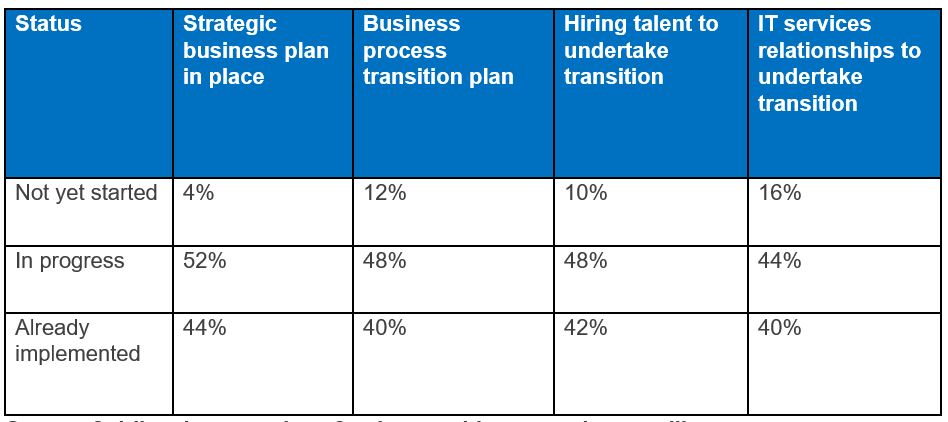

Carriers were asked how far along the path they are in adopting latest Iata Offer Order technology, protocols and processes

The airlines that responded to the Amadeus survey indicated they are bullish about the impact of the move to new protocols and standards for digital retailing, ecommerce, and distribution in the sector.

Iata’s New Distribution Capability (NDC) data standard is expected to eventually account for a quarter of sales through indirect channels as airlines look to personalise their offer through agents.

A key issue some airlines are grappling with this shift is the increased demand on their own IT systems due to the huge spike in search that is being generated by NDC shopping search enquiries.

Airlines also expressed interest in finding ways to grow their market through packaging up their seats as part of an overall holiday.

For low cost carriers one of the biggest challenges was cost of distribution, but they do see selling through agents as a way of potentially reaching new markets.

The Amadeus report concludes that the move to modern retailing is happening with a third of airlines planning to adopt Iata’s ‘Offer & Order’ technology this year, and a further 50% within the next five years.

A third of airlines are planning to implement new technology for offer creation and order management during 2024 and a further 50% say they intend to implement such technology over the coming five years.

Around 40% of airlines surveyed have already hired additional IT talent and put both business plans and processes in place, with almost all remaining airlines currently working on those tasks.

The vast majority of airlines told Amadeus they plan a “gradual shift” to Offer & Order management technology over the coming years, with 58% of airlines intending to implement the new model across existing interline partnerships as a first step.

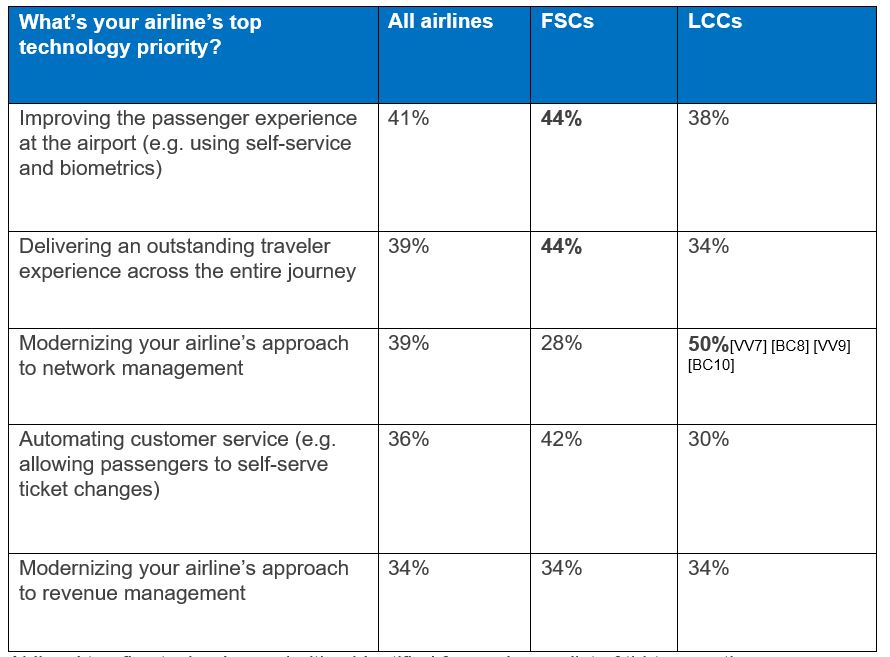

Low cost and full service carriers were asked what their top technology priorities are

44% said they would begin by gradually implementing Offer & Order across the airline’s own digital channels first.

However, roughly a third of airlines are planning a ‘big bang’ or ‘one-off’ switch to Offer & Order across all sales channels when they become ready.

Other priorities include the use of artificial intelligence to better plan schedules and networks, supporting self-service across digital and airport interactions, modernising ramp operations, and digitalising payments.

Cyril Tetaz, executive vice president airline solutions at Amadeus, said: “These findings match our own experience. Several Amadeus customers have firmly committed to digitally transforming their entire operation with new retailing technology.

“Doing so is helping airlines become customer and data driven so they can better understand passengers and deliver a truly traveller-centric experience. We’re ramping up our investments to support these trends. It’s an exciting moment for airlines and their passengers.”

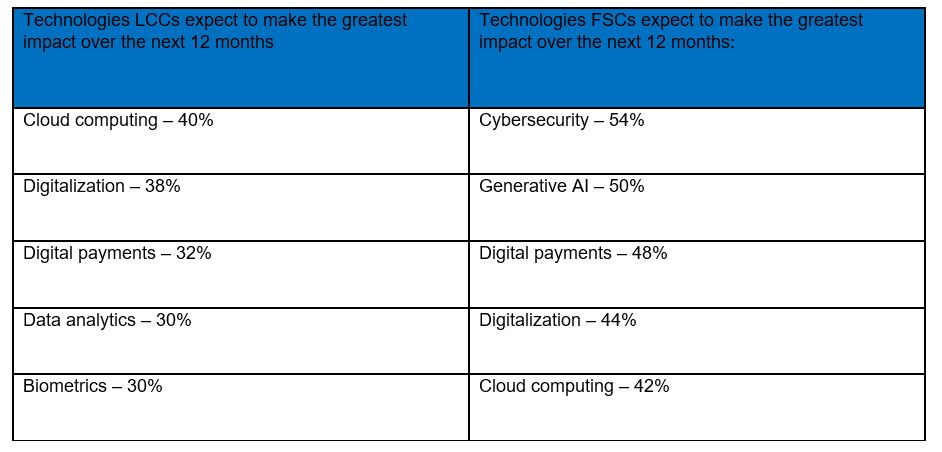

Carriers were also asked to choose the technologies expected to make the greatest impact over the next 12 months

Dave Evans, chief executive of Navitaire, the Amadeus subsidiary that provides technology for ecommerce, reservations and ancillary revenue, added : “Our data shows two-thirds of LCCs plan to increase investment in technology. Interestingly, the top drivers are ‘innovation’ and ‘revenue increase’ rather than cost reduction.

“While many LCCs already operate with Offer and Order style technology, the broader shift across the industry presents opportunities. For example, more than half of LCCs told us they plan to interline with traditional airlines when those carriers make the switch to new retailing technology.”