Increased demand in the aircraft secondary market and constrained OEM deliveries are the two key factors pushing up leasing rates, according to a new analysis from SMBC Aviation Capital.

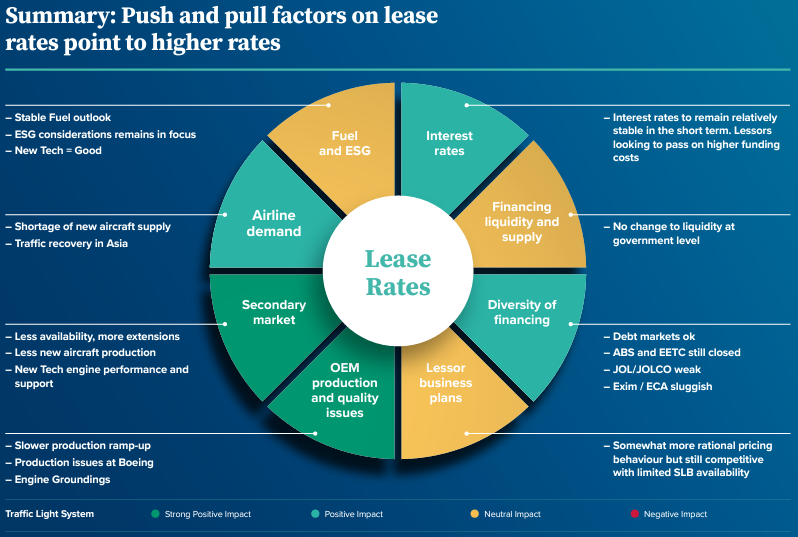

The market analysis looked at eight factors that feed into leasing rates and rated them as having either a negative, neutral, positive, or strong positive impact.

The analysis found none of the eight factors are having a negative impact, pushing leasing costs down, while secondary market demand and OEM production are having the most significant positive impact.

The report concludes that “OEMs issues are a multiyear challenge and as such will impact supply for at least two years”.

While production rates of new aircraft are increasing from the “trough of 2020”, quality issues, including problems Boeing has had with its 737-Max airframe, is significantly constraining deliveries.

This is having a knock-on impact in the secondary market with the age profile of the world’s Airbus and Boeing fleets skewing more towards assets that are more than six years old.

The SMBC report states: “So, despite production trending upwards, there remains a supply constraint for new aircraft which will lead to increased lease rates for new deliveries.

“This shortage has also led to an increased demand from airlines for extensions or secondary leases of current tech aircraft driving up lease rates for these types.”

It adds: “Since 2012 lessors account for almost two thirds of aircraft deliveries, the majority of which are through the SLB [Sale-Lease Back] market.

“Between 2013 and 2022 SLBs on narrowbody aircraft averaged 37% of deliveries but this dropped to 28% in 2023, driven by constrained production. With fewer SLB opportunities for lessors, increased competition means tighter returns.”

Of the other factors assessed, interest rates, airlines demand and diversity of financing were judged to be having a positive impact on leasing costs, while fuel and ESG [Environmental, Social and Governmental] issues, and lessor business plans were rates neutral.

The report concludes: “Our conclusion is that most of these factors point to lease rates in the secondary and new aircraft placement market to remain high.

“We believe the SLB Market will remain competitive due to the ongoing production issues at the OEMs reducing supply into the wider market.”

Click here to read the ‘Push And Pull Factors On Aircraft Leasing Rates’ market analysis in full.