Report finds Spirit Airlines has ‘significant structural and financial weaknesses’

A report has revealed that Spirit Airlines’ second Chapter 11 in twelve months is due to significant ‘structural and financial weaknesses’ at the carrier, even in a robust US aviation market.

According to a proprietary risk score from IBA Insight, which evaluates financial strength, access to capital, fleet and traffic, and jurisdiction risk, Spirit’s operational and financial metrics show severe imbalances. Despite the US achieving an 88% economic score within IBA’s jurisdiction model, one of the highest globally, Spirit’s net profit and EBIT margins remained below -20% in 2024, while the interest coverage ratio fell to -6.47, indicating operational cash flow could not cover liabilities.

The Florida-based LCC has endured a torrid few years. Apart from the two Chapter 11 proceedings, the airline was forced by regulators to call off a merger with JetBlue and has witnessed a steep decline in passenger numbers.

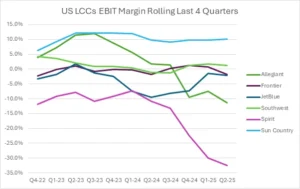

Data from IBA’s ‘Airlines Insights’ platform, found that Spirit’s EBIT margin (rolling last four quarters) declined more steeply than any other US low-cost carrier (LCC), plummeting from around -10% in Q4-22 to below -30% by Q2-25.

READ: Court allows Spirit Airlines to continue operations through Chapter 11

Intelligence from IBA found that the airline’s fleet and route strategies offered limited relief as Spirit scaled back to its most profitable routes, reducing network connectivity and undermining its product proposition.

Economies of scale rarely work in reverse and fixed costs became proportionally higher, with asset turnover dropping to 0.48, well below the healthy benchmark of 0.7. Premium product trials delivered a 6.9% yield increase in Q2, but load factors fell in the last two quarters, reflecting weaker demand and network identity.

Spirit’s fleet management provided short-term liquidity through the sale of 23 owned aircraft for US $500m, but ultimately did not solve structural challenges. Operating a young Airbus A320-family fleet simplified operations and reduced fuel volatility, but with a downside of larger leasing costs and costs associated with steeper depreciation.

Competition on major routes intensified, with only three of Spirit’s top ten routes holding more than 20% market share as of July 2025, down from five the previous year.

IBA warns that the ULCC model faces viability questions in the US, where operating costs remain elevated, leaving Spirit to decide whether to pivot its product, as Southwest has done, or focus on the riskier LCC approach of making new markets.

In the report, author Neil Fraser (CFA) noted that the carrier had been in the news for the wrong reasons lately.

“An airline’s ‘product’ is not just what you experience in flight, but also the frequencies and connectivity on offer, and they could further suffer,” noted Fraser. “It should also say that ‘economies of scale’ describes growth and rarely works the other way”.